Indian Railway Catering and Tourism Corporation(IRCTC) was founded in 27 September 1999, its headquarters is in New Dehli, India. IRCTC is an Indian public sector undertaking that provides ticketing, catering and tourism services for the state-owned Indian Railways. (IRCTC) was established in 1999 by Govt of India, operated under the ministry of Railways.

In 2019, it was listed on the National Stock Exchange and Bombay Stock Exchange with Govt holding a 67% ownership. Now IRCTC is trading near 815 level, there is a good opportunity will come as it will take support of 756 level and hold this level with consolidation then only a buying recommendation will come out for Short Term Investors whereas for long tern investors and SIP stock is trading near a good level to average it. Target for upcoming years are given below :

Current IRCTC Share price details :-

| Price Summary | Value (₹) |

|---|---|

| Today’s High | 827.30 |

| Today’s Low | 814.05 |

| 52-Week High | 1,138.90 |

| 52-Week Low | 700.00 |

Fundamentals of IRCTC Share :-

| Metric | Value |

|---|---|

| Market Cap | ₹ 65,288 Cr. |

| Enterprise Value | ₹ 63,025.35 Cr. |

| Number of Shares | 80 Cr. |

| P/E Ratio | 54.41 |

| P/B Ratio | 18.53 |

| Face Value | ₹ 2 |

| Dividend Yield | 0.79% |

| Book Value (TTM) | ₹ 44.04 |

| Cash | ₹ 2,262.65 Cr. |

| Debt | ₹ 0 Cr. |

| Promoter Holding | 62.4% |

| EPS (TTM) | ₹ 15 |

| Sales Growth | 20.58% |

| ROE | 38.93% |

| ROCE | 53.08% |

| Profit Growth | 10.48% |

Target for 2025-2030 in IRCTC :-

| Year | Target |

|---|---|

| 2025 | 920 |

| 2026 | 1000 |

| 2027 | 1080 |

| 2028 | 1150 |

| 2029 | 1280 |

| 2030 | 1400 |

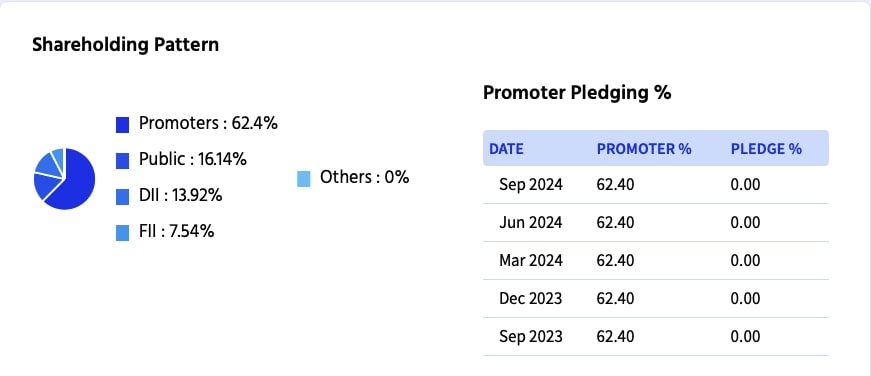

Shareholding in IRCTC :-

Quarterly Result (All Figures in Cr.) :-

| Particulars | MAR 2024 | JUN 2024 | SEP 2024 |

|---|---|---|---|

| Net Sales | 1,154.77 | 1,120.15 | 1,064.00 |

| Total Expenditure | 792.33 | 745.23 | 691.19 |

| Operating Profit | 362.44 | 374.92 | 372.80 |

| Other Income | 32.64 | 51.42 | 59.97 |

| Interest | 5.35 | 2.82 | 3.08 |

| Depreciation | 15.62 | 13.87 | 13.11 |

| Exceptional Items | 7.89 | 2.21 | 0.00 |

| Profit Before Tax | 381.99 | 411.85 | 416.58 |

| Tax | 97.81 | 104.13 | 108.71 |

| Profit After Tax | 284.19 | 307.72 | 307.87 |

| Adjustments | 0.00 | 0.00 | 0.00 |

| Consolidated Net Profit | 284.19 | 307.72 | 307.87 |

| Adjusted EPS (Rs) | 3.55 | 3.85 | 3.85 |

Profit & Loss (All Figures in Cr. Adjusted EPS in Rs.) :-

| Particulars | MAR 2023 | MAR 2024 |

|---|---|---|

| Net Sales | 3,541.47 | 4,270.18 |

| Total Expenditure | 2,265.25 | 2,804.22 |

| Operating Profit | 1,276.22 | 1,465.96 |

| Other Income | 120.43 | 164.48 |

| Interest | 16.11 | 18.64 |

| Depreciation | 53.73 | 57.22 |

| Exceptional Items | 27.20 | -58.53 |

| Profit Before Tax | 1,354.01 | 1,496.04 |

| Tax | 348.13 | 384.97 |

| Profit After Tax | 1,005.88 | 1,111.08 |

| Adjustments | 0.00 | 0.00 |

| Consolidated Net Profit | 1,005.88 | 1,111.08 |

| Adjusted EPS (Rs.) | 12.57 | 13.89 |

Balance Sheet (All Figures are in Crores.) :-

| Particulars | MAR 2023 | MAR 2024 |

|---|---|---|

| Equity and Liabilities | ||

| Share Capital | 160.00 | 160.00 |

| Total Reserves | 2,318.40 | 3,069.79 |

| Minority Interest | 0.00 | 0.00 |

| Borrowings | 0.00 | 0.00 |

| Other N/C Liabilities | 88.44 | 88.42 |

| Current Liabilities | 2,764.59 | 3,024.44 |

| Total Liabilities | 5,331.43 | 6,342.65 |

| Assets | ||

| Net Block | 324.35 | 316.55 |

| Capital WIP | 33.79 | 442.52 |

| Intangible WIP | 0.00 | 0.00 |

| Investments | 0.00 | 0.00 |

| Loans & Advances | 220.75 | 19.27 |

| Other N/C Assets | 27.50 | 27.37 |

| Current Assets | 4,725.04 | 5,536.94 |

| Total Assets | 5,331.43 | 6,342.65 |

Cash Flows (All Figures are in Crores.) :-

| Particulars | MAR 2023 | MAR 2024 |

|---|---|---|

| Profit from Operations | 1,354.01 | 1,496.04 |

| Adjustment | -23.89 | -56.40 |

| Changes in Assets & Liabilities | -89.39 | -109.68 |

| Tax Paid | -428.99 | -447.79 |

| Operating Cash Flow | 811.73 | 882.17 |

| Investing Cash Flow | -316.75 | -200.35 |

| Financing Cash Flow | -434.35 | -404.33 |

| Net Cash Flow | 60.64 | 277.49 |

IRCTC Future plans to provide better services to the customers :

New Railway Lines

- Malkangiri–Pandurangapuram: A 173.61 km railway connecting Odisha, Andhra Pradesh, and Telangana.

- Buramara–Chakulia: A 59.96 km line linking Jharkhand, West Bengal, and Odisha.

- Jalna–Jalgaon: A 174 km track connecting towns in Maharashtra.

- Bikramshila–Katareah: A 26.23 km line in Bihar.

- Amaravati Railway Line: An 87 km railway in Andhra Pradesh to connect key cities and ports.

- North Bihar Double Line: A 256 km railway to connect North Bihar with the Northeastern states.

Vision 2024

This is a plan to speed up important railway projects by 2024, focusing on:

- Electrifying all railway lines.

- Adding more tracks on busy routes.

- Increasing train speeds to 160 kmph on the Delhi-Howrah and Delhi-Mumbai routes.